DEG Server Pachinko King Championship Ver.2: Analyzing the Latest dYdX Trading Competition

Table of Contents

- Introduction

- Competition Overview

- Top Performers Analysis

- Trading Volume and Fee Analysis

- Performance Distribution

- Trading Behavior Insights

- Conclusion

Introduction

Following the successful launch of the dYdX Trading Arena platform in April 2025, the second iteration of the DEG Server Pachinko King Championship has concluded with impressive results. This one-week intensive trading competition, held from June 23 to June 30, 2025, brought together 57 active traders from the DEG community, Japan's largest cryptocurrency trader community managed by DEG san.

Competition Overview

The DEG Server Pachinko King Championship Ver.2 was designed as a short-term intensive competition focusing on ROI (Return on Investment) performance. The competition maintained the transparent, on-chain verification system that has become the hallmark of the dYdX Trading Arena platform.

Key competition parameters:

- Duration: 1 week (June 23 - June 30, 2025)

- Registered participants: 68

- Active participants: 57

- Minimum participation equity: $300

- Prize pool: $3,000 distributed among top performers

The competition used a straightforward ROI calculation method where:

- Baseline = Initial assets + Total deposits

- PnL (Profit and Loss) = Final assets - Baseline

- ROI = PnL / Baseline

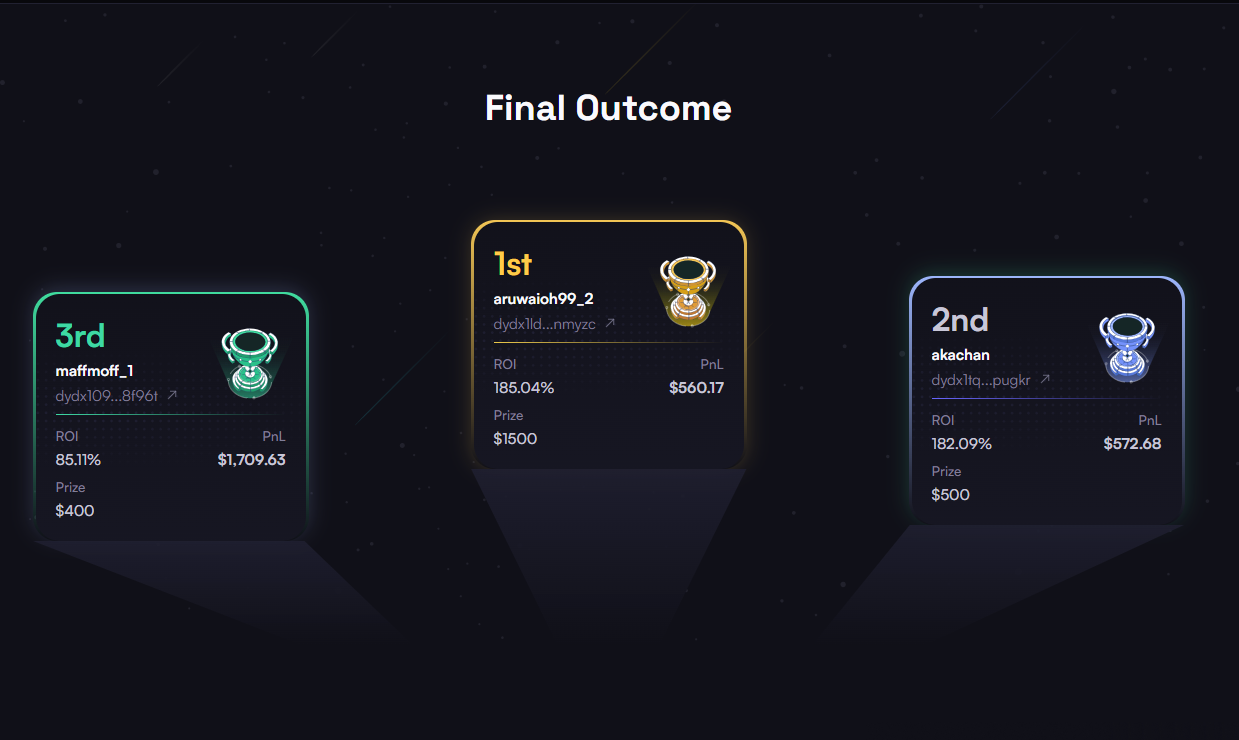

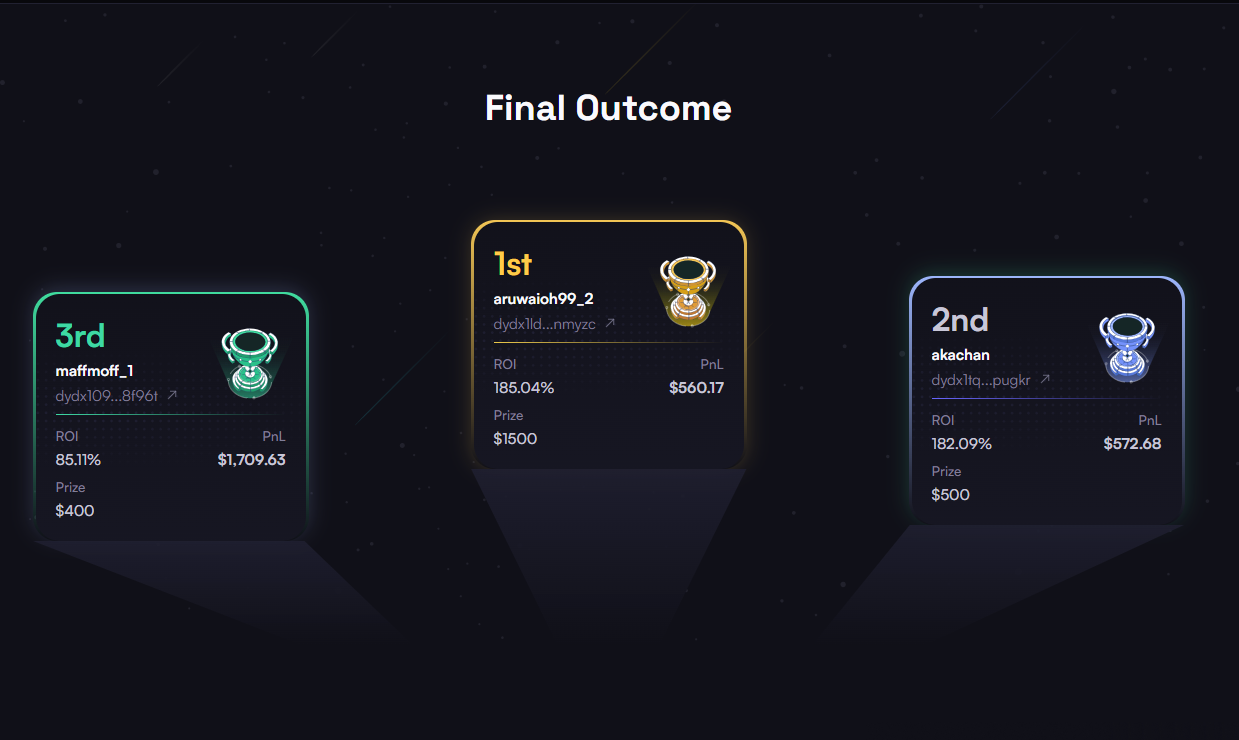

Top Performers Analysis

The competition showcased exceptional trading talent, with the top performers achieving remarkable returns:

- aruwaioh99_2

- ROI: 185.04%

- PnL: $560.17

- Prize: $1,500

- akachan

- ROI: 182.09%

- PnL: $572.68

- Prize: $500

- maffmoff_1

- ROI: 85.11%

- PnL: $1,709.63

- Prize: $400

It's worth noting that while aruwaioh99_2 secured the highest ROI and first place, maffmoff_1 generated the largest absolute profit at $1,709.63 with a significantly larger trading baseline of approximately $2,008.73.

The remaining prize pool was distributed among positions 4-10, with prizes ranging from $175 to $50, rewarding consistent performance across the leaderboard.

Trading Volume and Fee Analysis

The competition generated substantial trading activity on the dYdX platform:

- Total trading volume: Approximately 1,950,000 USDC

- Total fees generated: Approximately 794 USDC

The top volume generators demonstrated different trading strategies:

- papagoburei_1: 224,565 USDC volume (107.82 USDC in fees)

- akachan: 187,521 USDC volume (80.64 USDC in fees)

- nazokoi: 132,297 USDC volume (50.48 USDC in fees)

- maffmoff_1: 103,472 USDC volume (41.64 USDC in fees)

- jinthai: 102,384 USDC volume (33.13 USDC in fees)

Interestingly, high volume didn't always correlate with high ROI. For example, papagoburei_1 generated the highest volume but finished in 28th place with a negative ROI of -5.62%.

Performance Distribution

The competition revealed interesting performance patterns among participants:

- Positive ROI: 22 participants (38.6%) achieved positive returns, generating a total profit of $4,236.20

- Negative ROI: 35 participants (61.4%) experienced losses, totaling -$6,648.68

- Total loss (-100% ROI): 12 participants (21.1%) lost their entire trading capital

The overall PnL for all participants was -$2,412.48, indicating that the competition period presented challenging market conditions. This negative aggregate performance highlights the zero-sum nature of trading and the difficulty of consistently generating profits in volatile markets.

Trading Behavior Insights

Analysis of trading behavior revealed interesting patterns:

- Maker vs. Taker ratio: Approximately 83% of trades were executed as taker orders and only 17% as maker orders, suggesting participants favored aggressive trading strategies and immediate execution over passive limit orders.

- Activity rate: An impressive 98.2% of participants (56 out of 57) executed at least one trade during the competition, with only one participant (dera1331_1) remaining inactive.

- Trading style diversity: The data shows significant variation in trading approaches. Some participants like papagoburei_1 and akachan maintained high trading volumes with frequent position adjustments, while others adopted more conservative strategies with fewer trades.

Conclusion

The DEG Server Pachinko King Championship Ver.2 demonstrated the continued success of the dYdX Trading Arena platform in fostering competitive trading environments. With nearly $2 million in trading volume and impressive ROI performances reaching 185%, the competition showcased both the potential rewards and inherent risks of cryptocurrency trading.

The competition's transparent, on-chain verification system ensured fair play while providing valuable data insights into trading behaviors and performance metrics. As the dYdX Trading Arena platform continues to evolve, these competitions serve as both engaging community events and practical learning environments for traders of all experience levels.

For those interested in participating in future competitions, the dYdX Trading Arena platform continues to host regular events in collaboration with community leaders and KOLs. Visit https://dydxarena.com/ to learn more about upcoming competitions and how to participate.